News

Historic Leadership Shift: ECCIMA Elects Onyemelukwe As 18th President

The Enugu business community witnesses a major ECCIMA transition as Nnanyelugo Onyemelukwe emerges unopposed as the 18th President of the chamber, pledging growth, visibility and stronger member engagement.

The Enugu Chamber of Commerce, Industry, Mines and Agriculture (ECCIMA) has elected its former First Deputy President, Mr. Nnanyelugo Onyemelukwe, as the 18th President of the chamber for a two-year tenure.

Onyemelukwe replaced the outgoing President, Sir Odeiga Jideonwo, after emerging unopposed at the 52nd Annual General Meeting of ECCIMA held on Thursday at the chamber’s Secretariat in Enugu.

Addressing journalists ahead of the meeting, Jideonwo expressed gratitude to members for their support during his tenure and urged the new President to consolidate on existing achievements while correcting shortcomings to elevate the chamber’s performance.

He announced that the 37th Enugu International Trade Fair would hold from March 21 to March 30, 2026, with the theme “Empowering MSMEs for Global Competitiveness.” According to him, a comprehensive roadmap and strategy for the event had already been developed, with implementation underway.

Jideonwo said marketing activities for the trade fair commenced in 2025 through multiple channels and noted growing interest from both local and international organisations.

He called on institutions, government agencies and global partners to participate actively in the fair, describing it as a deliberately structured platform designed to deliver value across all stakeholder groups.

The outgoing ECCIMA President also commended the Enugu State Government for what he described as visible and sustainable commitment to urban renewal and infrastructure development.

He cited the construction of 260 Smart Schools, major investments in road and transport infrastructure, and broader governance reforms as evidence of the administration’s dedication to efficiency and service delivery, adding that these efforts were positioning Enugu State as a competitive and business-friendly destination.

Earlier, the Enugu State Governor, Peter Mbah, represented by the Commissioner for Commerce, Investment and Industry, Mr. Sam Nwobodo, formally declared the meeting open.

He urged ECCIMA and the wider business community to continue supporting the state government, assuring stakeholders that the administration remained open to constructive engagement and reforms.

In his acceptance speech, Onyemelukwe pledged to deepen member participation and strengthen business growth by integrating members into active sector-based business groups.

He said the chamber would prioritise digital visibility by fully activating its website to showcase members’ businesses globally, making information easily accessible to investors and partners worldwide.

According to him, the new leadership would focus on inclusiveness, innovation and practical support to ensure ECCIMA remains a strong catalyst for economic development in Enugu State and beyond.

Visit GMTNewsng for more news.

News

Reps Committee Confirms Tax Law Alteration as Minority Caucus Flags Multiple Versions

Tax Law Alteration allegations have been confirmed by a House of Representatives Minority Caucus Adhoc Committee, validating earlier claims of discrepancies between the versions of Nigeria’s new tax laws passed by the National Assembly and those later gazetted.

Tax Law Alteration confirmed as Reps Minority Caucus Adhoc Committee uncovers discrepancies in Nigeria Tax Administration Act 2025, citing three versions in circulation.

Saturday, January 24, 2026 | Abuja

Tax Law Alteration confirmed by Reps Minority Committee

Tax Law Alteration has been formally confirmed by the House of Representatives Minority Caucus Adhoc Committee constituted to probe alleged illegal changes to Nigeria’s newly enacted tax laws, particularly the Nigeria Tax Administration Act, 2025.

The seven-man fact-finding committee, chaired by Hon. Afam Victor Ogene, disclosed in its preliminary report that the concerns earlier raised on the floor of the House by Hon. Abdulsamad Dasuki were valid. The committee stated that multiple discrepancies were discovered when the Certified True Copies (CTCs) released by the House were compared with the earlier gazetted versions.

GMTNewsng had earlier reported the controversy surrounding the alleged Tax Law Alteration, following Dasuki’s alarm over the circulation of documents that differed from what lawmakers passed and the President assented to.

According to the committee, three different versions of the Nigeria Tax Administration Act, 2025 were found to be in circulation, a development it described as a serious procedural anomaly and an encroachment on the constitutional powers of the legislature.

“There were some alterations as alleged by Hon. Dasuki, especially in the Nigeria Tax Administration Act, 2025,” the committee stated in its interim report.

Speaker’s directive confirms procedural breach

The Minority Caucus recalled that on January 3, 2026, the House spokesperson, Rep. Akintunde Rotimi, announced that the Speaker, Rt. Hon. Abbas Tajudeen, directed the public release of the four tax reform Acts duly signed into law by the President. These include:

Nigeria Tax Act, 2025

Nigeria Tax Administration Act, 2025

Nigeria Revenue Service (Establishment) Act, 2025

Joint Revenue Board (Establishment) Act, 2025

The statement added that the Clerk of the National Assembly was instructed to align the Acts with the Federal Government Printing Press “to ensure accuracy, conformity, and uniformity.”

The committee noted that this directive itself was a clear indication that the earlier gazetted versions contained irregularities linked to Tax Law Alteration.

Key areas affected by Tax Law Alteration

Highlighting the contentious provisions, the committee listed several sections of the Nigeria Tax Administration Act, 2025 that materially differed from the version passed by the National Assembly:

Section 29(1): Reporting Thresholds

While the certified version approved ₦50 million for individuals and ₦100 million for companies, the gazetted version reduced the thresholds to ₦25 million for individuals and altered company thresholds, thereby widening the tax net without legislative approval.

Section 41(8) & (9): Mandatory 20% Deposit for Appeals

The gazetted Act introduced a requirement for taxpayers to deposit 20% of disputed tax sums before appealing to the High Court–provisions absent in the National Assembly’s version.

Section 64: Enforcement and Arrest Powers

The gazetted version expanded enforcement powers to include arrests and asset sales without court orders, a move the committee described as unlawful.

Section 3(1)(b): Definition of Federal Taxes

Petroleum Income Tax and VAT were removed from the federal tax definition in the gazetted copy, contrary to the certified legislative version.

Section 39(3): Currency of Tax Computation

The gazetted law mandated dollar-based tax computation for petroleum operations, while the authentic Act prescribed computation in the transaction currency.

Alterations also found in Revenue Service Act

The committee further identified Tax Law Alteration in the Nigeria Revenue Service (Establishment) Act, 2025, particularly in Sections 30(1)(d) and 30(3), where provisions empowering the National Assembly to exercise oversight through mandatory reporting were deleted in the gazetted version.

“This deletion shows total disregard for parliamentary oversight and the doctrine of checks and balances,” the committee said.

Call for extended investigation

Given the scale of the anomalies, the Minority Caucus Adhoc Committee concluded that the evidence before it was sufficient to justify a deeper probe.

“The illegalities observed undermine the constitutional powers of the National Assembly and Nigeria’s democracy,” the committee said, requesting an extension of time to conduct a more comprehensive investigation.

Visit GMTNewsng for more news stories.

News

Police Arrest Four Over Counterfeit $100 Notes In Gombe

A sweeping Counterfeit currency operation in Gombe has led to the arrest of four suspects found with hundreds of fake $100 notes, following an intelligence-driven police raid.

The Nigeria Police Force in Gombe State has arrested four suspects over alleged conspiracy and possession of 304 Counterfeit United States 100-dollar notes.

The command’s spokesperson, DSP Buhari Abdullahi, confirmed the arrests in a statement issued to journalists on Friday in Gombe.

According to Abdullahi, the suspects were apprehended during an intelligence-led operation carried out by officers of the Dukku Divisional Headquarters at about 11:00 a.m. on January 15, 2026.

He identified the suspects as Kabiru Abubakar, 29; Abubakar Aliyu, 30; Abdulrahman Mustapha, 22; and Isah Alhasan, 45, all from Dukku, Kaduna and Kano States.

“The suspects were arrested in possession of three hundred and four pieces of Counterfeit United States 100-dollar notes,” Abdullahi said.

He disclosed that preliminary investigations showed the suspects confessed to the offence and implicated another individual alleged to be the supplier of the fake currency.

In a related development, the police spokesperson said two additional suspects were arrested the same day in possession of substances suspected to be mercury.

According to him, the suspects admitted the substance was allegedly used in the production of Counterfeit currency.

Abdullahi further revealed that five other suspects were arrested for various offences, including a suspected bandit, with dangerous exhibits recovered during separate operations.

He added that a kidnapped victim was also rescued unhurt in the course of the police operations.

All the suspects, Abdullahi said, remain in police custody as investigations continue at the State Criminal Investigation Department.

Visit GMTNewsng for more news.

News

Bonga South West Project: Tinubu Approves Incentives to Unlock Jobs, FX

President Bola Tinubu has approved targeted incentives to accelerate the Bonga South West deep-offshore oil project, unlocking jobs, foreign exchange inflows, and new investments.

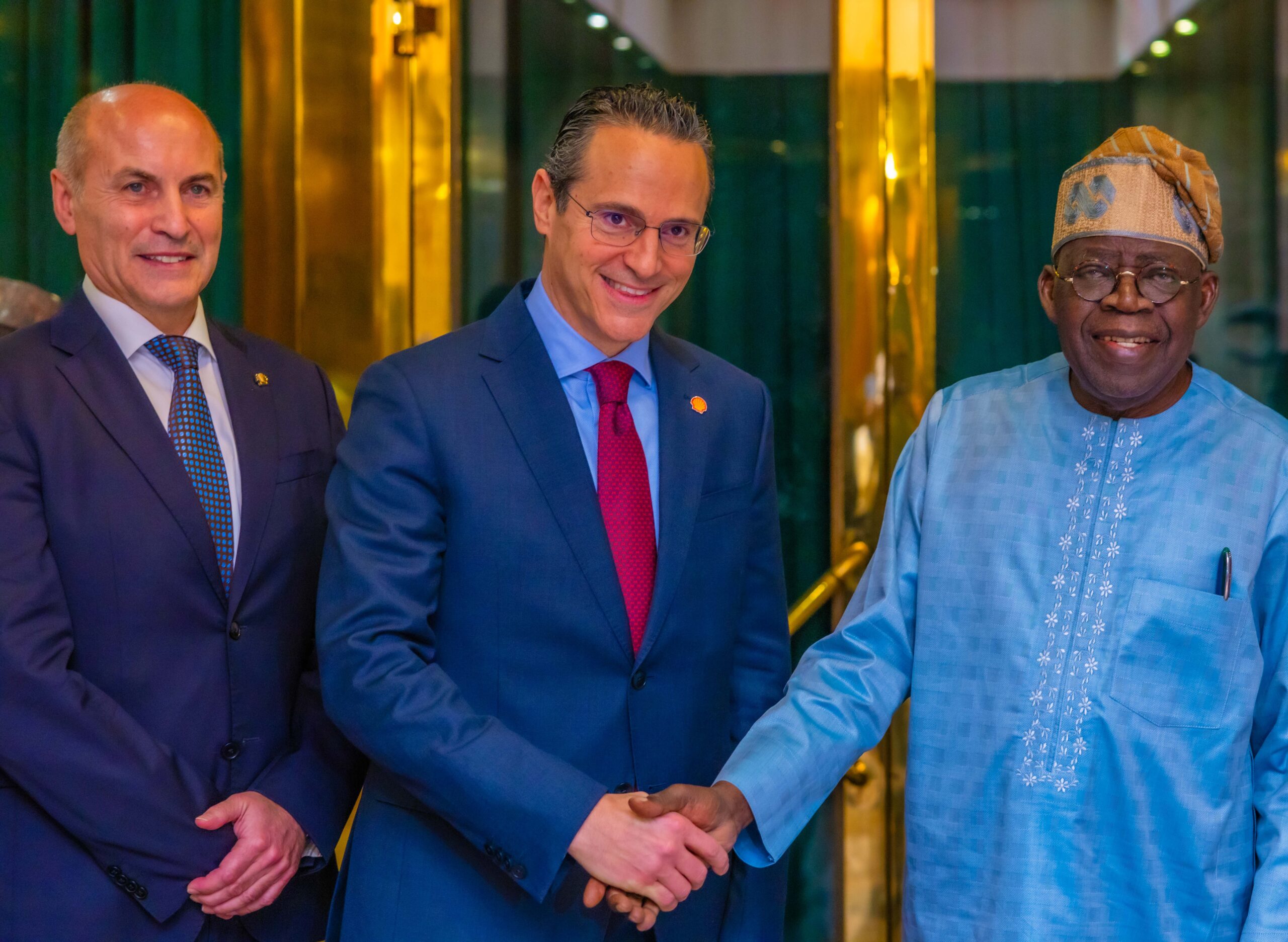

L-R: Peter Costello, President Upstream, Shell Plc, Wael Sawan, Global Chief Executive Officer Shell Plc and President Bola Tinubu during a visit by the Shell Executives to the President at the State House, Abuja. Thursday, January 22, 2026

L-R: Peter Costello, President Upstream, Shell Plc, Wael Sawan, Global Chief Executive Officer Shell Plc and President Bola Tinubu during a visit by the Shell Executives to the President at the State House, Abuja. Thursday, January 22, 2026

Bonga South West: President Tinubu approves targeted incentives to boost jobs, FX inflows, and investment through Shell’s Bonga South West offshore oil project.

Friday, January 23, 2026 | Abuja

Bonga South West received a major policy lift as President Bola Ahmed Tinubu approved the gazetting of targeted, investment-linked incentives to support the proposed deep-offshore oil project by Shell and its partners.

According to a State House press release issued by the Special Adviser to the President on Media and Public Communication, Mr. Sunday Dare, the incentives are designed to attract new capital into the oil and gas sector while safeguarding government revenues. President Tinubu also directed the Special Adviser to the President on Energy, Mrs. Olu Verheijen, to ensure the incentives are gazetted in line with Nigeria’s existing legal and fiscal frameworks.

Receiving a Shell delegation led by its Global Chief Executive Officer, Mr. Wael Sawan, the President explained that the incentives tied to Bonga South West are disciplined, ring-fenced, and globally competitive, with a clear focus on incremental production and strong local content delivery.

“These incentives are not blanket concessions. They are investment-linked and focused on new capital, in-country value addition, and Nigerian participation across the value chain,” President Tinubu said, stressing that Bonga South West is expected to reach Final Investment Decision within the first term of his administration.

The President described Bonga South West as strategic to Nigeria’s economic growth, noting that the project has the potential to create thousands of direct and indirect jobs, generate significant foreign-exchange inflows, and deliver sustained government revenues over its lifecycle. He added that it would further deepen local capacity in offshore engineering, fabrication, logistics, and energy services.

Reaffirming his administration’s commitment to policy stability and regulatory certainty, Tinubu said reforms in the energy sector are critical to restoring investor confidence and positioning Nigeria as a preferred destination for large-scale offshore investments, including Bonga South West.

He also disclosed that Shell and its partners have invested nearly US$7 billion in Nigeria within the last 13 months, particularly in Bonga North and HI projects, describing the investments as clear evidence that Nigeria’s economic and energy-sector reforms are delivering tangible results.

In his response, Mr. Sawan said Nigeria’s investment climate has improved remarkably under the Tinubu administration, adding that Shell is increasingly confident in Nigeria as a destination for long-term investments, with Bonga South West seen as a flagship opportunity.

The Shell delegation included senior executives from the company’s global and Nigerian leadership.

Visit GMTNewsng for more news stories.

-

News5 years ago

News5 years agoEnugu Community: Bloodbath imminent as traditional ruler plans forceful take over of ancestral land

-

Features5 years ago

Features5 years ago65 Hearty Cheers To Prof. Bart Nnaji, Aka Ji Oku, Nigeria’s Former Minister Of Power

-

News4 years ago

News4 years ago2023: Support one of our sons to be governor of Enugu State -Nkanu East leaders plead with other areas

-

Politics4 years ago

Politics4 years ago2023: Enugu State Governorship slot should go to Nkanu East ~Jim Nwobodo

-

Opinion5 years ago

Opinion5 years agoBIAFRA, KANU AND NIGERIA

-

News4 years ago

News4 years agoUgwuanyi an epitome of peace in Enugu State ~Owo Community

-

News5 years ago

News5 years agoHow Interpol intercepted IPoB leader in Europe

-

Politics4 years ago

Politics4 years agoEnugu: Nkanu East Leaders’ Forum Kicks Off Consultations For 2023 Governorship Slot